The Series 7 Exam, also referred to as the General Securities Representative Exam (GSRE), is a test administered by the Financial Industry Regulatory Authority (FINRA).

Once passed, the Series 7 Exam licenses the test taker to sell securities products. Stockbrokers need to pass the exam to trade. Make sure you are ready for the exam by taking one of the Series 7 practice exams below.

The exam focuses on things like investment risk, equity, taxation, retirement plans, and more.

It’s considered to be an introductory-level exam (not nearly as hard as the CFA Exam), as it is used to test the candidate’s basic knowledge of industry concepts that are critical to working in the financial sector.

Summary: Try a free Series 7 practice exam below and see what you already know.

Free Series 7 Practice Exams & Resources

We’ve compiled a list of free Series 7 practice exams, study guides, and other resources to help you prepare.

| Resource | Notes | Number of Practice Questions |

| Series 7 Flashcards1 | Quiz Yourself With These Free Flashcards on the Series 7 | 130 Flashcard Questions |

| Series 7 Flashcards2 | Quiz Yourself With a Different Set of Free Flashcards on the Series 7 | 125 Flashcard Questions |

| Series 7 Regulation Flashcards | Series 7 Regulation Specific Practice Questions | 331 Flashcard Questions |

| Series 7 Tax Flashcards | Series 7 Tax Specific Practice Questions | 224 Flashcard Questions |

Series 7 Exam Outline

To obtain a Series 7 license, you must pass the Series 7 Exam. This license, also known as the General Securities Registered Representative license, allows holders to sell a range of securities. License holders may sell corporate stocks and bonds, mutual funds, variable annuities, and packaged securities.

The Series 7 license is often preferred by banks and other types of broker dealers if you are just breaking into the financial sector. License holders are registered by FINRA as registered representatives, but they are usually referred to as stockbrokers.

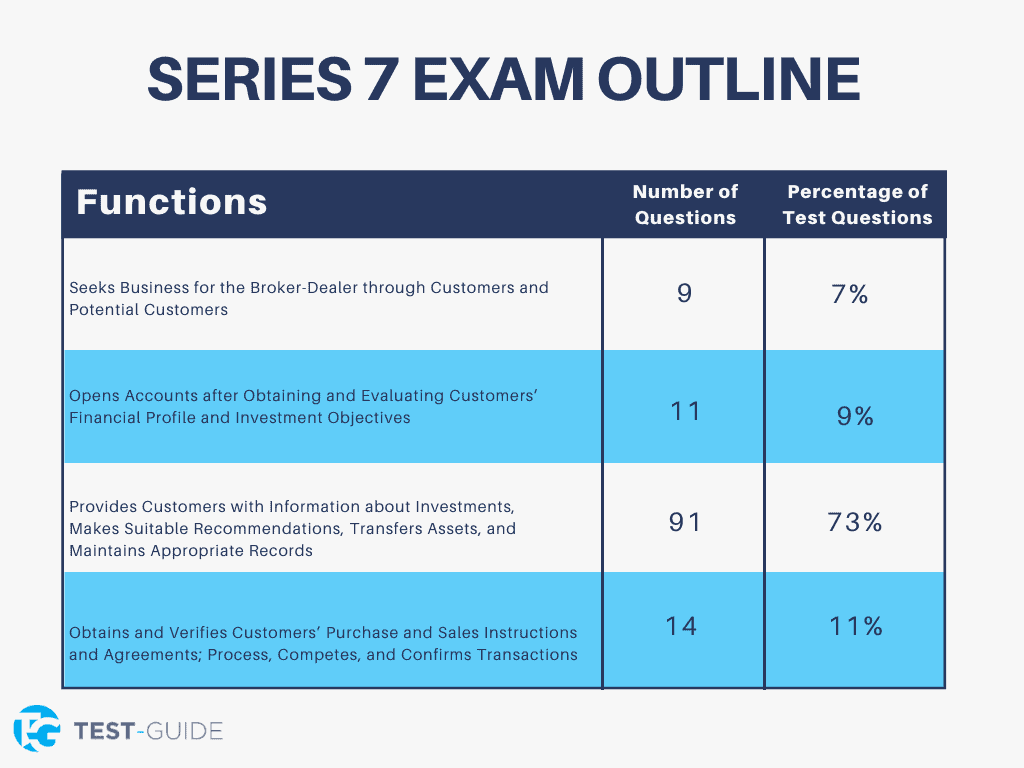

The test focuses on four functions and lasts for four hours. You are not permitted to break up this exam into separate days or appointments—all candidates must take the entire exam during their scheduled appointment.

Please note that the SIE Exam is a co-requisite to the Series 7 Exam. It is highly recommended that candidates take and pass the SIE Exam before taking the Series 7 Exam.

| Function | Number of Questions | Percentage of Test Questions |

| Seeks Business for the Broker-Dealer through Customers and Potential Customers | 9 | 7% |

| Opens Accounts after Obtaining and Evaluating Customers’ Financial Profile and Investment Objectives | 11 | 9% |

| Provides Customers with Information about Investments, Makes Suitable Recommendations, Transfers Assets, and Maintains Appropriate Records | 91 | 73% |

| Obtains and Verifies Customers’ Purchase and Sales Instructions and Agreements; Process, Competes, and Confirms Transactions | 14 | 11% |

The functions that are tested are the major job functions of future stockholders. It’s used to test competency of basic job skills. Because it’s essential to pass this test, taking a number of Series 7 practice exams is recommended before scheduling the real one.

Around 75% of questions are related to client investment information and it’s essential that you understand concepts over formulas.

This exam is considered to be the most difficult of all of the securities exams, which is why Series 7 practice exams are crucial.

Series 7 Exam Scheduling, Fees, and Administration

It’s important to understand how scheduling, fees, and other administrative tasks work before you take the Series 7 Exam.

Scheduling Your Series 7 Exam

To enroll for the exam, visit the FINRA site. After you enroll, you may schedule your exam by visiting Prometric’s scheduling page or by calling 1-800-578-627.

When you schedule your Series 7 Exam, Prometric will need some identifying information. This includes:

- Name and FINRA ID# (you will receive this after you enroll for the exam).

- Phone number.

- The name of the exam (in this instance, it would be Series 7).

Unlike other exams, the Series 7 requires that you take the test in its entirety on your scheduled day. The test is just under four hours long, so be prepared to spend your day at the testing facility. It is recommended that you schedule your exam three to four weeks out. You may schedule your exam up to 120 days after you’ve been registered through FINRA.

The exam costs $245 that is due when you schedule your testing appointment.

How is the Series 7 Exam Administered?

The Series 7 Exam is administered through Prometric, just like every other securities qualifications exam. If you do not pass the test on the first attempt, you may retake the exam after 30 days. You can retake the exam as many times as you’d like, but there are time restrictions in place. After three failed attempts, a candidate must wait at least six months to retake the Series 7 Exam.

Series 7 Exam Requirements

Before you take the Series 7 Exam, you need to appropriately prepare. If you have a finance background, be prepared to study for at least 80-100 hours and lay out a study plan that will ensure you reach those hours. For those who do not come from a financial background, you’ll have to study harder with at least 150 hours behind you. Use study guides and resources, like a Series 7 practice exam to help you pass.

Before you take your Series 7 Exam, you must pass the Securities Industry Essentials (SIE) Exam. Technically, the SIE Exam is a co-requisite to the Series 7 Exam, but it is highly recommended that you take and pass the SIE Exam first.

The SIE Exam focuses on a variety of financial topics including regulatory agencies and the securities market. This exam has four sections with 75 questions total. Once this exam is passed, you are eligible to take the Series 7 Exam. You can find SIE practice questions here.

In order to obtain your Series 7 license, you must:

- Take and pass the SIE Exam.

- Be sponsored by FINRA.

- Pass a background check.

- Submit for fingerprints.

- Receive a passing grade of at least 72% on the Series 7 exam.

Once you receive your license, you can sell corporate stocks and bonds, mutual funds, municipal bonds, and packaged securities. Someone who decides to work with a Series 7 license holder will expect them to have expert knowledge on a variety of topics like:

- Retirement plans.

- Stocks.

- Bonds.

- Mutual funds.

- Annuities.

- 529 college plans.

- Taxes.

You will also be expected to understand how to create diversified portfolios with appropriate risk assessment. While you can sell any securities with a Series 7 license, you cannot sell products relating to commodities, real estate, or life insurance.

Series 7 Exam Scoring

The passing score for the Series 7 Exam is 72%. The test is scored by an equating scale, which accounts for slight variations of difficulty that could occur due to the different sets of exam questions created for candidates. This way, there is a fair comparison of scores and holds each candidate to the same standard.

FINRA doesn’t release specific pass/fail information, but on average the pass rate is around 65%. This is considerably lower than other exams, like the Series 63 which averages an 86% passing rate. This is why it’s recommended to put in many hours of studying, reviews, and practice exams.

Series 7 FAQS

Can anyone take the series 7 exam?

You must have FINRA sponsorship in order to take the Series 7 Exam. While the SIE Exam does not require sponsorships, the Series 7 does.

To obtain your Series 7 license, you must pass both the Series 7 Exam and the SIE exam.

How long does it take to study for Series 7?

It’s recommended to spend between 80-100 hours studying for this exam if you are familiar with the financial industry or have a finance background.

Those who are just breaking into the industry should allot at least 150 hours of studying time.

Is obtaining my Series 7 license lucrative for my career?

Many license holders make up to $150,000 the first year after completing their test and passing all background checks. It’s a lucrative career option that many choose to go into.

What kind of education do I need to take the Series 7 exam?

You do not need any type of formal education background to take the Series 7 Exam. While you do need to register with FINRA and pass the SIE exam to get your license, a Bachelor’s degree or other type of educational background is not required.

How difficult is the Series 7 exam?

The Series 7 Exam is considered medium-high level of difficulty. The average pass rates for the exam is around 65%. It’s considered to be harder than the SIE exam and more preparation will be required to pass it.