All CPA Practice Tests

Listed below are all of our CPA practice exams. This exam is very grueling and requires a ton of preparation.

Choose which subject you want to practice below and begin your studies.

Financial Accounting and Reporting Section

Audit Section

Business Environment and Concepts Section

Regulation Section

AICPA Practice Exam

Review the following AICPA released questions to see some additional CPA test questions. These do not have answer explanations, but are still very helpful.

| Resource | Notes | Answer Explanations? |

|---|---|---|

| AUD Sample Test | AICPA sample test on the audit portion of the exam. | No |

| FAR Sample Test | AICPA practice exam on the financial accounting and reporting section. | No |

| BEC Sample Test | AICPA practice exam on the business environment and concepts section. | No |

| REG Sample Test | AICPA sample test on the regulation portion of the exam. | No |

Additional CPA Study Resources

Use the additional CPA questions below for more help in preparing for you exam. The resources below are CPA sample questions, but in flashcard format.

| Resource | Notes |

|---|---|

| BEC Flashcards | 157 BEC flashcards(Quizlet) |

| AUD Flashcards | 78 AUD flashcards (Quizlet) |

| REG Flashcards | 260 REG flashcards(Quizlet) |

| FAR Flashcards | 207 FAR flashcards(Quizlet) |

CPA Formulas You Should Know

Here are some formulas that you should know that will come up when taking the CPA exam.

| Name | Formula |

|---|---|

| Profit Margin | Net Income/Net Sales |

| Asset Turnover | Net Sales/Average Assets |

| Financial Leverage | Assets/Equity |

| Return on Assets | Net Income/Average Assets |

| Return of Equity | Net Income/Average Equity |

| Return on Sales | Net Income/Sales |

| Capital Turnover | Sales/Capital |

| Return on Investment | Income/Capital |

| Gross Margin Ratio | Gross Margin/Net Sales |

| Operating Profit Margin | Operating Profit/Net Sales |

| Ending Inventory | Beginning Inventory+Purchases-Cost of Sales |

| Retained Earnings | Beginning Retained Earnings+Net Income-Dividends |

| Contribution Margin | Sales-Variable Costs |

| Pension Formula | Contributions+Expected Rate of Return-Service Costs-Interest Costs |

| Basic EPS | Earnings Per Common Share/Weighted Average Common Stock Shares Outstanding |

| Times Interest Earned (TIE) | EBIT/Interest Payments |

| Operating Leverage | % Change EBIT / % Change Sales |

| Quick Ratio | (Current Assets-Inventory)/Current Liabilities |

| COGS | Beginning Finished Goods+Cost of Goods-Ending Finished Goods |

| Inventory Turnover | COGS/Average Inventory |

| Accounts Payable Turnover | COGS/Average Accounts Payable |

| WACC | (Cost of Equity x Weight of Equity)+ Cost of Debt x (1-Tax Rate) x Weight of Debt |

| Payback Period | Initial Investment/Yearly Cash Flows |

| Market Capitalization | Common Stock Price Per Share x Number of Common Stock Shares Outstanding |

| Dividend Payout Ratio | Dividends/Net Income or Yearly Dividends Per Share/EPS |

| P/E Ratio | Common Stock Price Per Share/EPS |

| Market to Book Ratio | Market Value/Book Value |

| Book Value Per Share | Common Stock Equity/Common Shares Outstanding |

| Breakeven | Fixed Costs/Contribution Margin |

How Do I Practice for the CPA Exam?

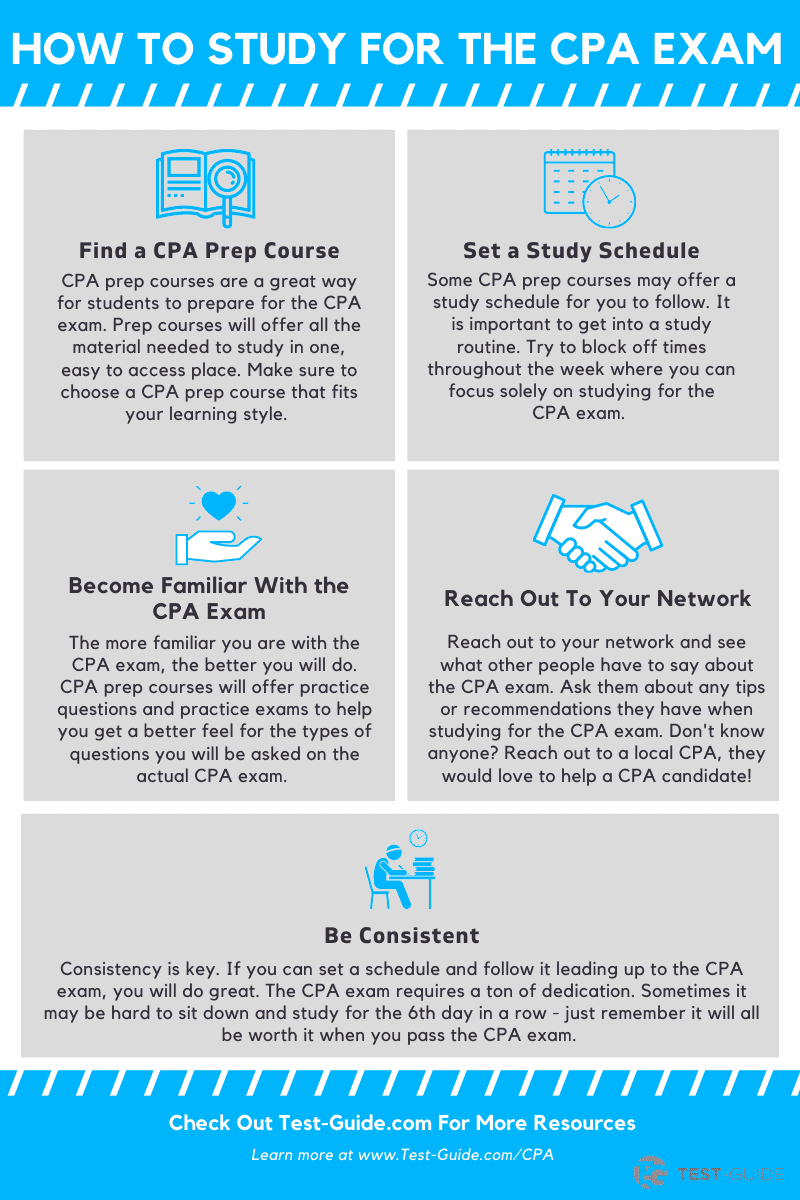

With CPA pass rates hovering around 50%, students should utilize all possible study resources when preparing for this exam. Taking the CPA exam will require a ton of time and commitment. One way to save some time and ensure you are studying the correct concepts is by using a prep course.

A prep course will help save you a ton of time by giving you all the information and tools you need, in one, easy-to-access place. A lot of these courses also include study schedules and other useful tools to improve your studying experience.

Prep courses will cover all materials that will be tested on the exam. As well as covering all materials, they will also be continuously updated to reflect the most current information. Think of a CPA review course as an investment – those who earn their CPA designation should expect a pay bump.

Some companies may even pay for some of the costs associated with CPA review courses.

Bottom Line – Start preparing with our free CPA exams above. If you require more help, consider investing in a prep course.

Sections of the CPA

The exam is comprised of 4 different sections. Each section takes 4 hours to complete. You do NOT have to take all 4 sections at once. Most individuals will space them out. You will need to pass all 4 sections within an 18-month period.

The 4 section on the CPA exam include:

- Auditing and Attestation (AUD)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

- Business Environment and Concepts (BEC)

For more information on the exam or the individual sections, read our guide to the CPA exam.

Frequently Asked Questions

Is the CPA exam actually hard?

The CPA exam is considered one of the hardest professional exams to pass.

According to the AICPA, financial accounting and reporting had the lowest passing rate of the 4 CPA exam sections. Financial accounting and reporting had a passing rate of 46.37%.

The next hardest section was audit and attestation with a passing rate of 47.97%. Candidates concerned about passing the CPA exam start by taking a practice exam above.

What kind of questions are on the CPA exam?

The CPA exam has 3 different kinds of questions – multiple choice, task-based simulations, and written communication tasks.

The multiple-choice questions will have 4 possible answers. The task-based simulations will be based on “real-world” problems and candidates will have to type in their answers. The written communication tasks will require candidates to write their answers and their communication skills will be tested.

Can you self-study for the CPA?

Candidates can absolutely self-study for the CPA exam. With that being said, candidates may save a lot of time by investing in a CPA review course.

This is a personal decision and will vary for each CPA candidate.