CFA stands for Chartered Financial Analyst®. Many professionals in the finance industry will try and obtain their CFA certificate. CFA practice questions are a great way to help prepare for the actual exam.

Individuals who earn their CFA designation will be able to move up in the finance industry and increase their pay. Make sure you are ready for all levels of your CFA exam with our free CFA practice questions.

Summary: Review the free CFA practice questions below to test your knowledge.

Free CFA Practice Questions

Use these CFA practice questions to help you get a passing score on the CFA exam.

| Resource | Notes | Number of Questions |

| CFA Level I – Quantitative | Free flashcards reviewing CFA level I quantitative methods. | 221 |

| CFA Level I – Economics | Free flashcards reviewing CFA level I economics. | 289 |

| CFA Level I – Ethics | Free flashcards reviewing CFA level I ethics. | 65 |

| CFA Level I – Financial Reporting + Analysis | Free flashcards reviewing CFA level I financial reporting. | 96 |

| CFA Level I – Corporate Finance | Free flashcards reviewing CFA level I corporate finance | 97 |

| CFA Level I – Equity Investments | Free flashcards reviewing CFA level I equities. | 125 |

| CFA Level I – Fixed Income | Free flashcards reviewing CFA level I fixed income. | 227 |

| CFA Level I – Derivatives | Free flashcards reviewing CFA level I derivatives. | 63 |

| CFA Level I – Portfolio Management | Free flashcards reviewing CFA level I portfolio management. | 105 |

| CFA Institute | If you are already registered to take the CFA, you can access mock exams and practice questions via CFA Institute. | 100+ |

CFA Exam Outline

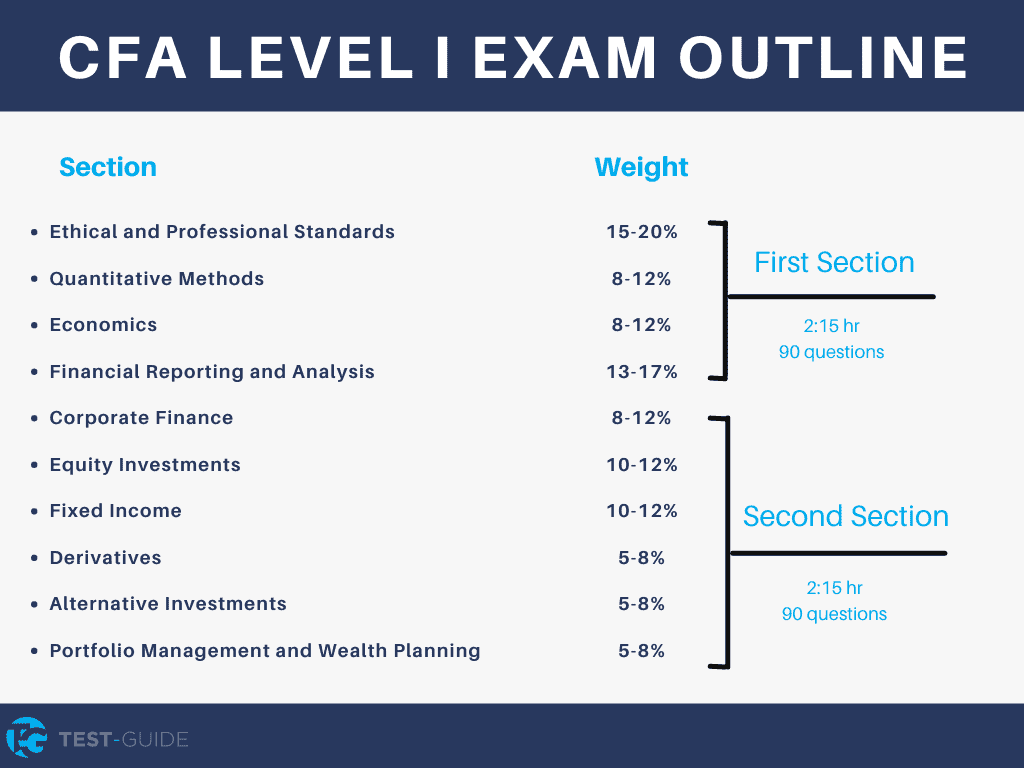

The CFA exam consists of 3 different levels – level I, level II, and level III. Students must pass each level before proceeding to the next level. CFA exam level I consists of 180 multiple choice questions. Students will take the exam in two sessions with the opportunity to take a break between sessions.

Students will be tested in the following categories for CFA level I:

| Section | Exam Weight |

| Ethical and Professional Standards | 15-20% |

| Quantitative Methods | 8-12% |

| Economics | 8-12% |

| Financial Reporting and Analysis | 13-17% |

| Corporate Finance | 8-12% |

| Equity Investments | 10-12% |

| Fixed Income | 10-12% |

| Derivatives | 5-8% |

| Alternative Investments | 5-8% |

| Portfolio Management and Wealth Planning | 5-8% |

Students will take section one of the CFA level I exam first. Students will be given 2 hours and 15 minutes to answer 90 multiple choice questions. This first section will cover the following topics:

- Ethics and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

After completing the first section of the exam, students will have an opportunity to take a break – this is completely optional. The second section will also consist of 90 multiple choice questions and will last for 2 hours and 15 minutes. The second section will cover the following topics:

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management

If you do the math, students should average about 90 seconds per question if they wish to finish the CFA exam on time. This could vary as you may spend more or less time depending on how difficult the question is. Make sure you are ready for the CFA exam by studying some CFA practice questions.

CFA Testing and Dates

The CFA is now a computer-based exam. Students will need to register for their desired CFA exam – level I, level II, or level III. After students register for their exam, they must then schedule their actual exam appointment. You can register for the CFA exam on CFA Institute’s website.

CFA Level I Dates

Students who will be taking CFA level I exam can register for 4 different exam periods in 2023.

| Exam Period | Actual Dates |

| February 2023 | February 14th – Febraury 20th |

| May 2023 | May 16th – May 22nd |

| August 2023 | August 22nd – August 28th |

| November 2023 | November 11th – November 17th |

CFA Level II Dates

Students who will be taking CFA level II exam can register for 2 different exam periods in 2023.

| Exam Period | Actual Dates |

| May 2023 | May 23rd – May 27th |

| August 2023 | August 29th – September 2nd |

| November 2023 | November 18th – November 22nd |

CFA Level III Dates

Students who will be taking CFA level III exam can register for 2 different exam periods in 2023.

| Exam Period | Actual Dates |

| February 2023 | February 21st – February 23rd |

| August 2023 | August 29th – September 5th |

CFA Exam Fees

Students will need to pay a one-time enrollment fee of $450 the first time they register when taking the CFA level I exam. This one-time enrollment fee is only applied for first time CFA test takers. If you decide to take CFA level II and level III, you will not have to pay the enrollment fee.

When registering to take the CFA exam, students will see two different fees – an early registration fee and a standard registration fee. The early registration fee is $700 and the standard registration fee is $1000.

Early registration typically ends 6 months before the exam is taking place. If you know that you will be taking the CFA exam well in advance of the exam it may be a good idea to register early and save some money.

Students used to have pay a $250 fee to reschedule their exams but due to COVID related issues, students now only have to pay $25 to reschedule an exam.

CFA Requirements

In order to register for the CFA level I exam, you must meet ONE of the following requirements:

- Bachelor’s Degree

- Final-Year Student – Must be in final year of your program of study on the date of enrolling for CFA level I.

- Professional Work Experience – Have a combined 4 years of work experience between a full-time job and college education. The dates of work and education cannot overlap. Internships count towards CFA experience if they are paid and full-time. Part-time jobs do not count.

The only requirement for CFA level II and CFA level III are passing the previous level of the CFA exam.

CFA Exam Scores

The CFA exam is unique in that students can only receive two scores – “pass” or “did not pass”. Students will be able to see their performance for each section on the CFA but will not be able to see which questions they got right or wrong. CFA practice questions are a great way for students to gauge their knowledge for individual subjects within the CFA.

Students will also be able see how they did when compared to their peers. Students will see a percentile rank that compares them to other test takers. If you feel that your score is not correct and want it recalculated, you can submit an appeal to the CFA institute. Please note that the CFA institute does provide a list of candidates who passed the exams to various professional institutes.

Results typically take 60 days for students who took CFA level I and CFA level II exams. For students who took CFA level III, results could take up to 90 days. Students will be able to access their results for up to 1 year after the test. If you need to access your results after 1 year, you can request an official letter from the CFA to confirm you passed the exam.

Students who receive a “did not pass” on their exam can re-register for an exam as soon as scores are released. The same is true for students who “passed” their exam and want to take the next level of the CFA.

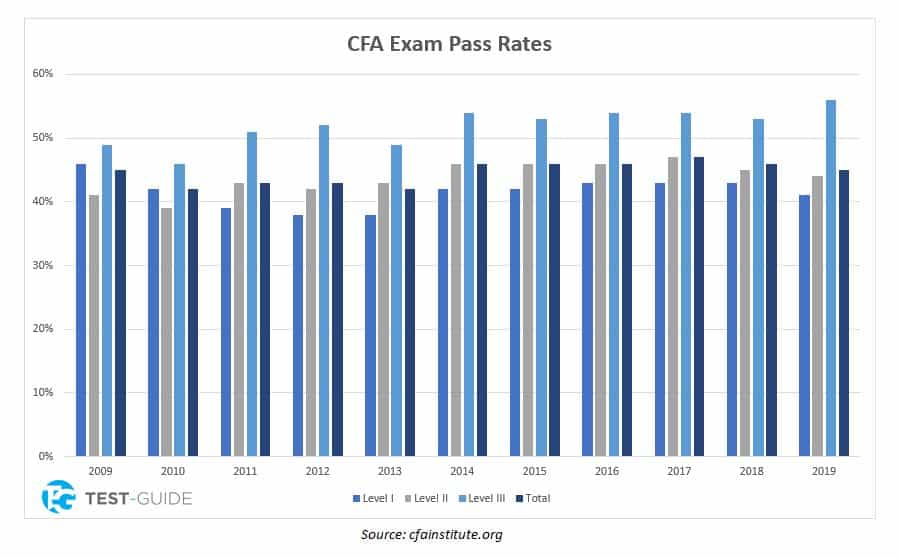

Passing scores on the CFA exam vary from year to year. The minimum passing score is not public knowledge and is set by the CFA Institute Board of Governors. You can see how passing scores for the CFA exam have varied throughout the years below.

CFA Exam FAQs

What is the CFA exam pass rate?

The exact CFA exam pass rate varies slightly from year to year. For December of 2019, the pass rate for Level I was 42%. Of candidates who register for the Level I exam, 20% ultimately complete all three levels.

Are CFA prep courses worth the money?

The CFA exam has 3 levels, all of which are challenging. Earning a CFA designation will accelerate any career. Making an investment in a CFA prep course will pay dividends in the long run.

What is on the CFA level 1 exam?

The CFA exam is always changing. Last year’s CFA level I exam consisted of 240 multiple-choice questions and was made up from ten different sections.

What is a CFA exam?

CFA stands for chartered financial analyst. The exam is taken by applicants, usually investment or financial professionals, who wish to achieve the CFA professional designation. There are 3 levels of the CFA exam.