The SIE Exam is one of the best ways to distinguish yourself from your peers if you want to jump into the financial services sector. SIE practice exams are a great way to study for the actual exam.

Whether you want to become a member of a stock brokerage firm or join FINRA itself, you’ll likely need to take the SIE exam and score well to make it in this competitive professional market.

Our guide to the SIE exam will go over eveything that is on the exam as well as provide some SIE practice exams to help you study.

Summary: Review some of the free SIE practice exams below to see how much you already know.

Free SIE Practice Exams & Questions

Our free SIE practice tests will help you pass your SIE exam. Use our answer explanations at the end of the exams to help you better understand the material.

Other SIE Prep Resources

Check out these SIE prep resources for more SIE materials.

| Resource | Notes | Number of Questions |

| FINRA SIE Practice Exam | Official SIE practice exam from FINRA’s website. | 175 |

| SIE Practice Questions | SIE practice questions in flashcard format. | 141 |

| SIE Questions – Understanding Products | Questions related to SIE section about understanding products and their risks. | 168 |

| SIE Questions – Capital Markets | Questions related to SIE section about capital markets. | 59 |

| SIE Questions – Customer Accounts | Questions related to SIE section about customer accounts. | 58 |

| SIE Questions – Regulatory Framework & Rules | Questions related to SIE section about regulatory framework and industry rules. | 40 |

SIE Exam Outline

The SIE Exam can be taken by anyone 18 years of age or older. It’s particularly a good idea for those interested in entering the financial services industry to take the SIE exam. You can take the exam either before or after you are associated with or employed by a firm.

Additionally, any exam results are valid for four years after taking the test, providing a generous window during which you can pursue employment after test completion.

The test is 75 questions long in a multiple-choice format. It’s administered over one hour and 45 minutes and costs $60 each time you take the exam.

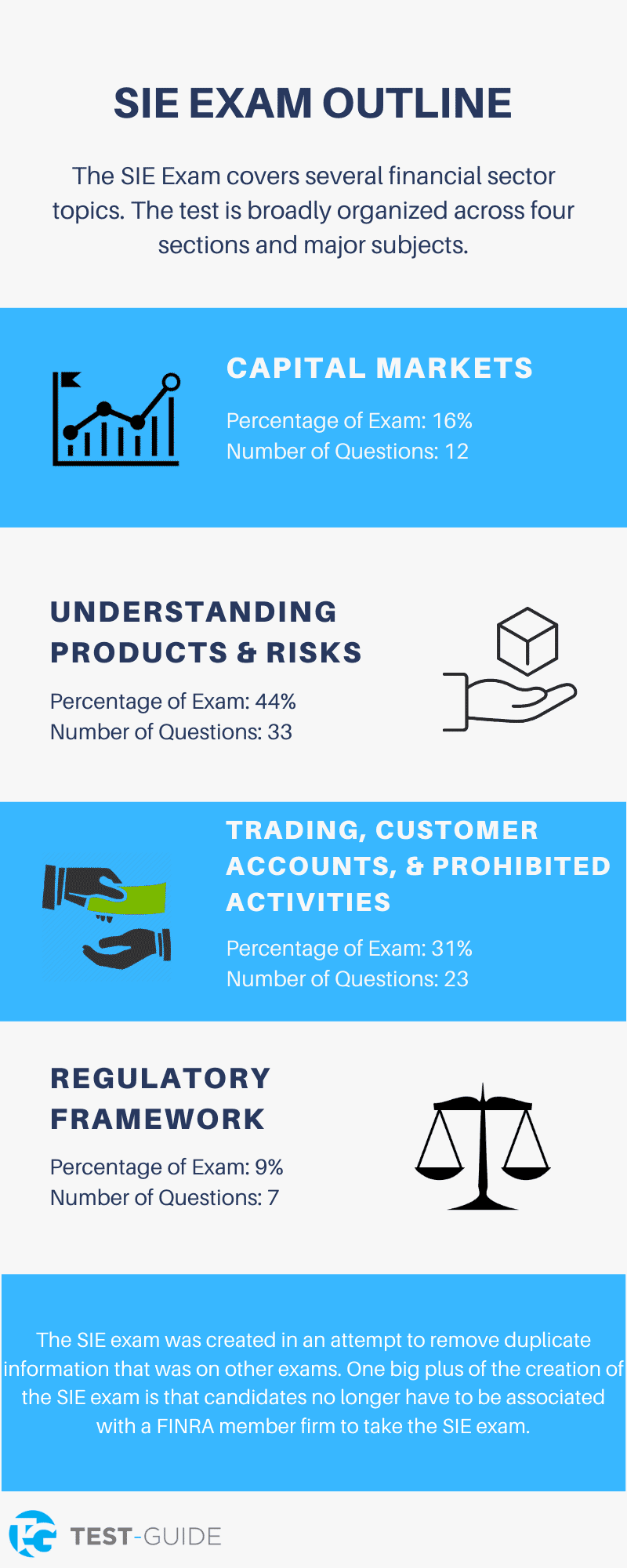

Overall, the SIE Exam covers several financial sector topics. The test is broadly organized across four sections and major subjects. The most recent version of the test has:

| Section | Description | Percentage of Exam | Number of Questions |

| 1 | Capital Markets | 16% | 12 |

| 2 | Understanding Products & Risks | 44% | 33 |

| 3 | Trading, Customer Accounts, & Prohibited Activities | 31% | 23 |

| 4 | Regulatory Framework | 9% | 7 |

The exam is scored out of 100 and a passing score is considered to be 70 or above. Higher scores are always considered better for potential employees, especially if they submit the scores to firms.

Please note that the SIE exam is relatively new and has replaced portions of the following exams:

- Series 6 – Investment Company Representative

- Series 7 – General Securities Representative

- Series 22 – DPP Representative

- Series 55/56 (now series 57) – Securities Trader

- Series 79 – Investment Banking Representative

- Series 82 – Private Securities Offerings Representative

- Series 86/87 – Research Analyst

- Series 99 – Operations Professional

These exams are usually referred to as “Top-Off Exams.”

The SIE exam was created in an attempt to remove duplicate information that was on all of the above exams. One big plus of the creation of the SIE exam is that candidates no longer have to be associated with a FINRA member firm to take the SIE exam.

The top-off exams are now exclusively for individuals that fall in specific categories and require the additional certification for their career.

Why Take the SIE Exam?

The SIE Exam may be necessary for many financial or stock market firm employees, so anyone interested in getting a start in the sector will likely want to take and pass this exam with as high a score as possible. It’s also a great way to separate yourself from other potential firm employees, particularly if you don’t have a lot of experience under your belt.

Candidates who take and pass the SIE exam may be eligible for bonuses or pay increases. Having the SIE designation on your resume will allow you to do more things with the company, which helps justify the increase in pay.

Having the SIE designation could also help you excel your career in the financial services industry. There is only so much you can do without having the SIE designation or other similar top off exams.

SIE FAQs

Do you need to be associated with a broker-dealer to take FINRA qualifications exams (top-off exams)?

Yes. Series 6, 7, 22, 57, 79, 82, 86/87, and 99 require candidates to be employed or sponsored by a FINRA member.

The SIE exam does not require candidates to be employed or sponsored by a FINRA member.

Can you take a qualification exam and the SIE on the same day?

Yes. So long as you meet the qualifications for all the exams, you can take both exams on the same day, although you’ll need to find seats at the same testing center. Of course, you’ll also need to make sure that the exams take place during different time slots.

Is the SIE testing score adjusted?

Yes. The passing score for the SIE Exam is normally 70 out of 100, but every exam score is placed on a common scale with other test scores for that particular session.

Statistical adjustments may be necessary depending on the exam session and in conjunction with the exam scores received from other test-takers. This ensures that every exam score is fair regardless of the exact questions on the test.

How many times can you take the SIE exam?

You can take the SIE Exam two times back to back. If you want to take the exam for the third time, you must wait 30 days before reapplying for another session. Taking the test for the fourth time necessitates a 180-day waiting period.

This waiting period is repeated for every subsequent test attempt. Thus, it’s best to try to pass the exam with as high a score as you can manage before your fourth attempt.

Can I take the SIE exam at college?

Yes. You must take this exam at a designated Prometric testing center. Many universities have these centers nearby or even integrated with their campuses. You may take this test even if you have not graduated from college.